Amazon Stock Beta / Alpha R X Beta By New Standards Men On Amazon Music Amazon Com : The volatility of amazon.com inc.

Amazon Stock Beta / Alpha R X Beta By New Standards Men On Amazon Music Amazon Com : The volatility of amazon.com inc.. The s&p 500 index is the base for calculating beta with a value of. Wall street stock market & finance report, prediction for the future: The volatility of amazon.com inc. A beta of 1 would signify that the beta is neutral. Back then, it was believed that stocks would have better liquidity at a lower price;

Find the latest beta for amazon.com, inc. A few may remember that amazon's stock (amzn) was divided three times in its early days. Current and historical p/e ratio for amazon (amzn) from 2006 to 2020. The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share (eps) number. Back then, it was believed that stocks would have better liquidity at a lower price;

Beta is a component of the capital asset.

On ipo day the stock price rose and closed at $23.50 putting the company at a value of. Stock analysis for amazon.com inc (amzn:nasdaq gs) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Amazon expands boston tech hub with plans to create 3,000 new jobs jan 26 2021; Conversely, a stock with a beta lower than 1 is expected to rise less than the market when the market is moving up , but fall less than the market when the market is moving down. Amazon expands investment in metro detroit, creates thousands. Amazon.com to webcast fourth quarter 2020 financial results conference call jan 19 2021; There's no denying amazon (nasdaq: Beta is a measure of risk commonly used to compare the volatility of stocks, mutual funds, or etfs to that of the overall market. The pe ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. A beta greater than 1.0 suggests that the stock is more volatile than the broader market, and a beta less than 1.0 indicates a stock with lower volatility. Beta is a measure of risk commonly used to compare the volatility of stocks, mutual funds, or etfs to that of the overall market. Gurufocus requires market premium to be 6%. Back then, it was believed that stocks would have better liquidity at a lower price;

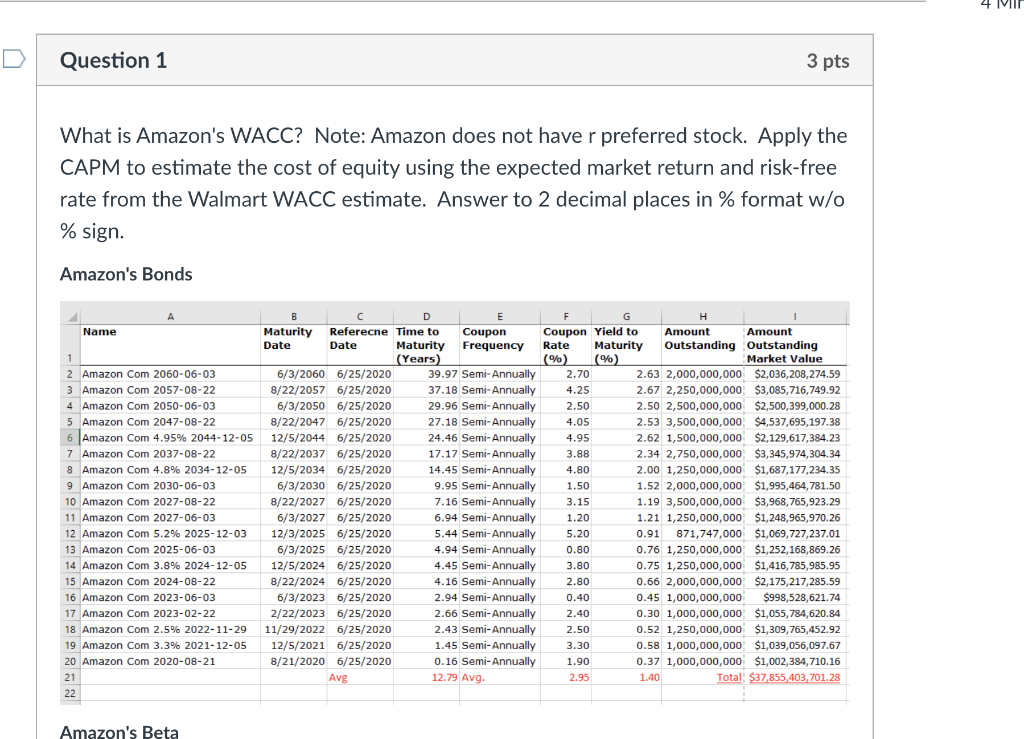

17 shareholders are therefore subject. This is slightly lower than 1. Cost of equity = 1.11000000% + 1.17 * 6% = 8.13%. You'll find the amazon share forecasts, stock quote and buy / sell signals below.according to present data amazon's amzn shares and potentially its market environment have been in a bullish cycle in the last 12 months (if exists). This story was previously published in february 2019.

This is slightly lower than 1.

There's no denying amazon (nasdaq: The s&p 500 index is the base for calculating beta with a value of. On ipo day the stock price rose and closed at $23.50 putting the company at a value of. It was rewritten with new information and republished. You'll find the amazon share forecasts, stock quote and buy / sell signals below.according to present data amazon's amzn shares and potentially its market environment have been in a bullish cycle in the last 12 months (if exists). Wall street stock market & finance report, prediction for the future: Beta is a measure of risk commonly used to compare the volatility of stocks, mutual funds, or etfs to that of the overall market. (amzn), including valuation measures, fiscal year financial statistics, trading record, share statistics and more. According to this measure is slightly lower than the market volatility. The measure of an asset's risk in relation to the market (for example, the s&p500) or to an alternative benchmark or factors.roughly speaking, a security with a beta of 1.5, will have move. Marketbeat's consensus price targets are a mean average of the most recent available price targets set by each analyst that has set a price target for the stock in the last twelve months. () stock market info recommendations: Amazon beta analysis beta is one of the most important measures of equity market volatility.

This story was previously published in february 2019. Access over 100 stock metrics like beta, ev/ebitda, pe10, free cash flow yield, kz index and cash conversion cycle. Find out all the key statistics for amazon.com, inc. Beta is a risk metric that measures the risk associated with a security in comparison to the risk associated with the market overall. () stock market info recommendations:

(amzn) stock quote, history, news and other vital information to help you with your stock trading and investing.

A summary of key financial strength and profitability metrics. You'll find the amazon share forecasts, stock quote and buy / sell signals below.according to present data amazon's amzn shares and potentially its market environment have been in a bullish cycle in the last 12 months (if exists). Access over 100 stock metrics like beta, ev/ebitda, pe10, free cash flow yield, kz index and cash conversion cycle. Beta is a measure of risk commonly used to compare the volatility of stocks, mutual funds, or etfs to that of the overall market. Beta is a risk metric that measures the risk associated with a security in comparison to the risk associated with the market overall. Find the latest amazon.com, inc. Conversely, a stock with a beta lower than 1 is expected to rise less than the market when the market is moving up , but fall less than the market when the market is moving down. When did amazon stock (amzn) split? According to this measure is slightly lower than the market volatility. Amazon expands boston tech hub with plans to create 3,000 new jobs jan 26 2021; Amazon.com to webcast fourth quarter 2020 financial results conference call jan 19 2021; Beta can be thought of as asset elasticity or sensitivity to market. Wall street stock market & finance report, prediction for the future:

Komentar

Posting Komentar